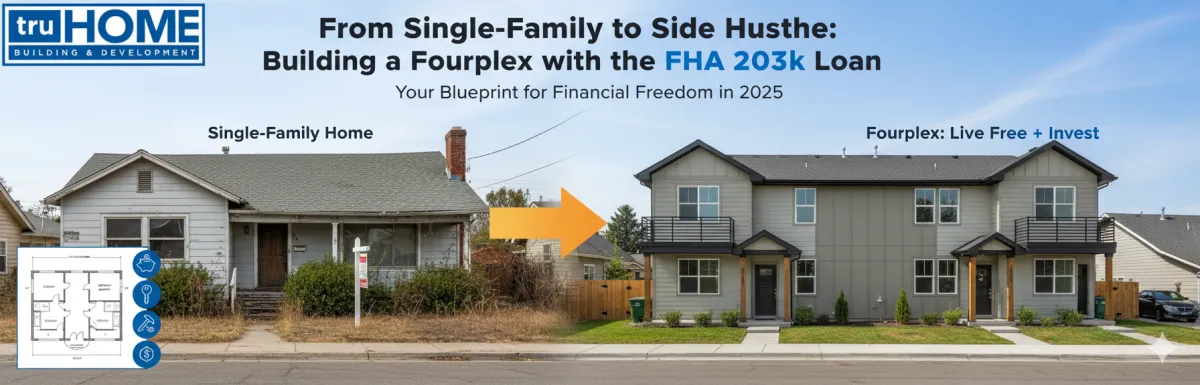

From Single-Family to Side Hustle: Building a Fourplex with the FHA 203k Loan

Ready to buy your first home and become a real estate investor at the same time? It sounds like a dream, but it’s entirely possible. Imagine this: you live in one unit of your brand-new fourplex, and the rent from your other three tenants covers your entire mortgage payment. This powerful strategy, known as "house hacking," is within reach for first-time buyers using a special tool: the FHA 203k Complete loan.

Let's dive into how you can turn a fixer-upper into a cash-flowing asset right here in 2025.

The Ultimate All-in-One Loan: What is an FHA 203k? 🤔

Think of the FHA 203k loan as a financial Swiss Army knife for homebuying. It bundles the purchase price of a home and the cost of major renovations into a single mortgage. Because it's insured by the Federal Housing Administration (FHA), you can qualify with a down payment as low as 3.5%.

For a massive project like converting a single-family home into four separate units, you'll need the FHA 203k Complete (also called the Standard 203k). This loan is built for heavy-duty, structural changes—from moving walls and adding kitchens to re-wiring the entire property. It’s the key that unlocks your property’s hidden potential.

Your Blueprint: From One Door to Four 🗺️

This journey is more involved than a typical purchase, but the payoff is huge. Here's your step-by-step blueprint.

Step 1: Find Your 203k-Savvy Lender

Don't just walk into any bank. Your first call should be to a mortgage lender who specializes in FHA 203k loans. Their expertise is non-negotiable. Getting pre-approved will give you a clear budget for both the property purchase and the total renovation.

Step 2: Hunt for the Perfect Project Property

This is where you need vision. Team up with a real estate agent and look for a single-family home with the right bones for a conversion.

Zoning is Everything: Before you do anything else, check the local zoning laws. You must confirm with your city’s planning department (whether in Medford or another town) that the property's zoning allows for a multi-family structure with four units. If not, you have to move on.

Space & Layout: Look for a large home where you can easily envision separate entrances, kitchens, and living spaces. A big lot is a bonus for parking and potential additions.

Step 3: Assemble Your Renovation Power Team

You can't do this alone. You'll need two key experts on your side before making an offer:

A Licensed General Contractor: This pro will create a detailed, line-by-line bid that outlines the entire scope of work, from demolition to the final coat of paint.

A HUD-Approved 203k Consultant: This is your project referee. They work for the lender to verify your contractor's bid is realistic and meets FHA standards. During construction, they'll inspect the progress before any payments are released.

Step 4: Lock In the Future Value

Once your offer is accepted, the lender will order an appraisal based on the "after-repair value" (ARV). This means the appraiser values the property as if the fourplex conversion is already complete. Your loan is based on this higher, future value! After closing, the renovation funds are held safely in an escrow account.

Step 5: Let the Transformation Begin!

Now the fun starts. Your contractor gets to work, and the property begins its metamorphosis. The renovation funds are released in stages (called "draws"). As each phase is completed, your 203k consultant inspects the work, approves it, and the lender releases the next payment to your contractor.

Step 6: Move In & Start Cashing Checks

After the final inspection, you get the keys to your completed fourplex! You can move into your unit and begin marketing the other three to tenants. The moment your first tenant pays rent, you've officially become a house-hacking real estate investor.

The Reality Check: Is This Right For You?

This path isn't for everyone. Let's weigh the good with the challenging.

The Rewards:

Forced Equity: You're not waiting for the market to grow; you're creating massive value and equity through renovation.

Live for Free (or Cheap!): Tenant rent can drastically reduce or completely eliminate your housing costs. 💰

Low Barrier to Entry: A 3.5% down payment makes multi-family ownership accessible.

Simplicity: One loan, one monthly payment.

The Hurdles:

Patience Required: The 203k process involves more paperwork and people, so it takes longer than a standard loan.

The Right Team is Crucial: Finding experienced 203k professionals can be the toughest part of the process.

You're a Landlord Now: Be prepared for the responsibilities of managing properties and tenants.

Construction Delays: Renovations can hit unexpected snags. Flexibility is key.

For the determined first-time buyer, leveraging the FHA 203k loan to create a fourplex is more than a home purchase—it's a launchpad for building long-term wealth.

Let truHOME Building and Development be part of your team in your long-term wealth journey! Visit us at: www.oregonmultiplex.com.